Interactive Brokers launches local AED funding in the UAE

Interactive Brokers (IBKR) now offers a local AED funding option for UAE investors:

By opening an AED account with First Abu Dhabi Bank (FAB), UAE clients can wire UAE dirhams directly to IBKR without routing through a foreign bank.

This means transfers are far faster and cheaper. Instead of waiting 3-4 days and paying AED 100-150 in SWIFT fees on a London-based AED account, most UAE banks will treat the FAB transfer as local, often free and near-instant.

The upshot: you fund your IBKR account in AED quickly, and then convert to USD at IBKR’s very tight AED/USD rate (the official 3.6729 peg).

For context on IBKR’s platform, see our Interactive Brokers review.

What this means for UAE investors

- Fast & free transfers: Direct AED transfers to FAB/IBKR in hours.

- Low fees: No more AED100-150 SWIFT charges; most banks have zero fees for local FAB transfers.

- Better FX rate: IBKR uses the official AED–USD peg (≈3.6729) with minimal spread, beating typical bank rates (~3.674+).

These changes make AED funding at IBKR much smoother for UAE expats and investors. Previously you had to send AED via IBKR’s UK bank account, risking wrong currency and big fees. Now the process is localized.

How the FAB account works

In practice, IBKR has told FAB (First Abu Dhabi Bank): “Keep AED for us in this account.”. When you send AED to FAB’s IBKR account, FAB acts as the correspondent bank. They collect your dirhams and pass them on (or convert them) for IBKR.

Because it’s a correspondent setup, some banks may warn that you’re transferring to a foreign account and sometimes charge a fee. (This is similar to any international wire.)

However, by using FAB as the local route, most UAE banks now treat the transfer like an onshore payment. As Steve Cronin from DeadsimpleSaving notes:

“for most banks the transfer into IB seems to be free”

Steve Cronin, UAE financial coach

The only catch is you must send in AED (not accidentally in USD or AED→GBP) and include your IBKR reference, so the funds get to the right account.

Step-by-step: Deposit AED via the FAB account

To fund your IBKR account in AED, follow these steps in the IBKR Client Portal:

- Open IBKR Client Portal: On a web browser, go to Transfer & Pay > Transfer Funds > Deposit Funds.

- Select UAE Dirhams: Choose “Use a new deposit method” (if you haven’t added one) and select United Arab Emirates Dirham (AED) as the currency.

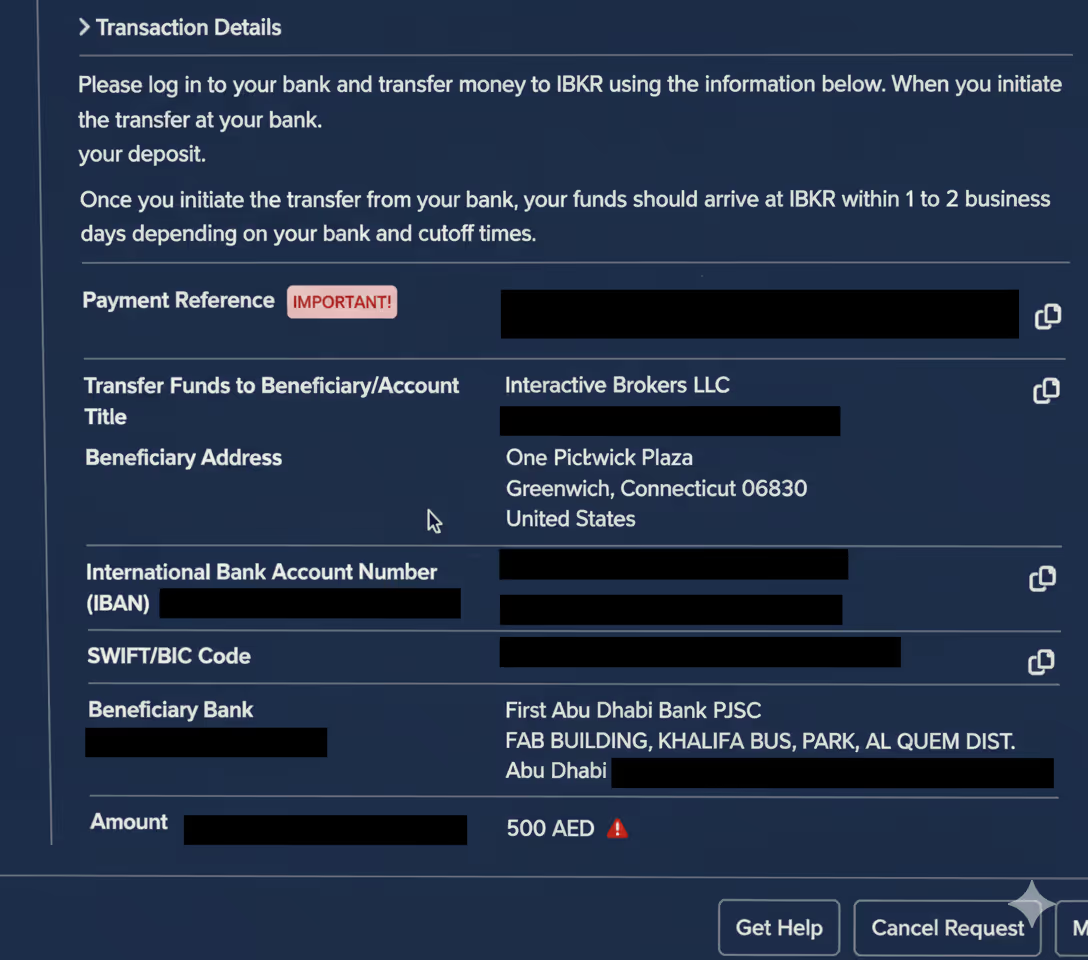

- Get wire instructions: Click Get Instructions under the Bank Wire section. IBKR will display the wire details, including a FAB (NBAD) IBAN and SWIFT code (note it ends in “VOS,” indicating a Vostro account). It will also show your unique IBKR reference code.

- Create the transfer: In your UAE bank’s online banking (preferably the desktop portal), add a new payee and send the desired AED amount to that FAB account. It’s wise to start with a small test transfer to verify everything.

⚠️ Important: include your IBKR reference code in the payment reference/remarks field. IBKR is not a bank, so without the code, it won’t know who the money is for.

Once sent, the AED should post to your IBKR account very quickly, often the same day or next morning.

In the end, your transfer instructions should look like this:

Converting AED to USD in IBKR

Once your AED lands in IBKR, it will appear in your multi-currency portfolio. If your base currency is USD, you’ll eventually want to convert. There are two main ways:

- Manual Conversion: Place a forex trade on IBKR. To convert AED to USD, you buy USD.AED (i.e. buy USD using AED). Note that IBKR currently uses USD.AED rather than an “AED.USD” pair. IBKR does not charge extra conversion fees beyond its standard (tiny) forex spread. In fact, IBKR’s AED/USD rates are excellent – effectively the official peg of ~3.6729. This outclasses typical bank exchange rates (often 3.674-3.675).

- Auto-Conversion: IBKR offers an automatic currency conversion feature. If enabled, any residual AED balance above a small threshold can be auto-converted to USD at IBKR’s rate. (This setting is found under Account Settings > Auto/Residual Conversions.) This ensures your cash is always in your base currency without manual trades.

Either way, you never have to convert AED through a local bank. All currency exchange happens inside IBKR’s platform at wholesale rates.

Even if you do convert to another currency, IBKR has excellent exchange rates and automatic transfers can make investing easy.

Old vs. new AED funding: a comparison

In summary, the new FAB AED route eliminates the old pain points. UAE investors now send AED locally, saving on fees and time.

Conclusion

For UAE-based and expat investors, IBKR’s FAB AED account is a game-changer.

You can fund your IBKR account in dirhams, just like a domestic transfer, and then access global markets.

Remember to follow the steps above, include your IBKR reference code, and do a small test transfer. Once set up, future AED deposits will be quick, cheap, and smooth.

For a full overview of Interactive Brokers and its features (commissions, platform, currency options, etc.), see our in-depth Interactive Brokers review on BrokerMatch.

Do your own research: explore the Interactive Brokers website.

Have feedback or questions? Feel free to reach out to us!