eToro review 2025 for Emiratis & Expats

Hello, fellow investor in the UAE!

In this review, we’ll take a deep dive into eToro from the perspective of a UAE investor, whether an Emirati or an Expat, to help you determine if it’s the right investment platform for your needs as a UAE resident.

We recommend eToro for those looking to invest in US stocks, cryptocurrencies, and social trading, where you can follow and copy the trades of other investors. You also gain access to other investment products, including ETFs and CFDs (leveraged positions) on stocks, commodities, forex, and indices.

eToro is a well-established fintech platform and a global leader in the social trading space, with more than 35 million users worldwide. Its growing popularity is driven by commission-free ETF trading (and low fees on stock trading), a user-friendly platform available on both desktop and mobile, and strong social investing features.

As part of its marketing strategy in the UAE, eToro promotes its trading app by offering a free stock or cryptocurrency (your choice) worth $50 upon signing up and making a minimum deposit of $200.

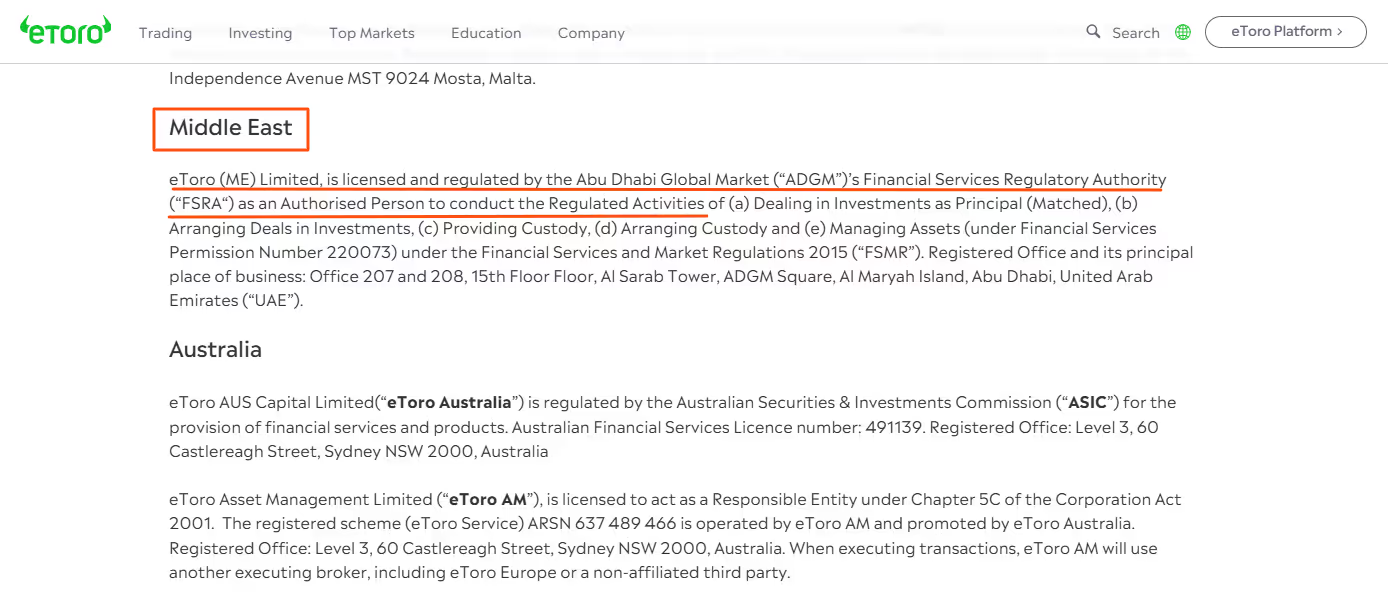

In the UAE, it operates through eToro (ME) Limited, which is fully licensed and regulated by the Abu Dhabi Global Market’s (ADGM) Financial Services Regulatory Authority (FSRA).

Opening an account from the UAE is a straightforward process. You can also test the platform using a demo account loaded with $100,000 in virtual funds.

On the downside, withdrawals incur a flat fee of $5 and may take several days to process, while spreads can be high on specific instruments, such as cryptocurrencies or forex pairs.

That’s our eToro UAE review in a nutshell. If you're looking for a more detailed breakdown tailored specifically for UAE users, continue reading!

Highlights

New in 2025 (UAE):

- Local markets: eToro (ME) now offers ADX and DFM stocks to UAE clients via its ADGM licence.

- Stock fees change: $1 for US/UK/EU, $2 for AU/HK/DFM/ADX; ETFs remain commission-free.

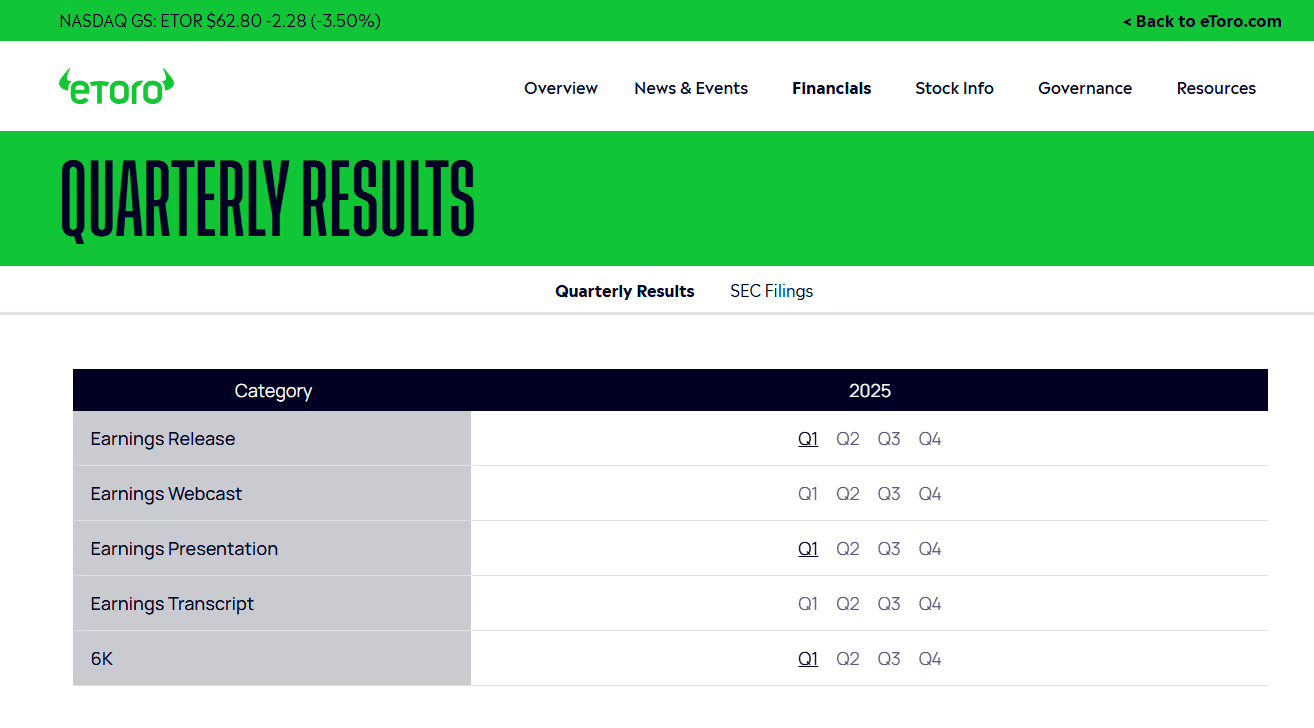

- Public company: eToro listed on Nasdaq: ETOR in 2025, increasing disclosure and financial transparency.

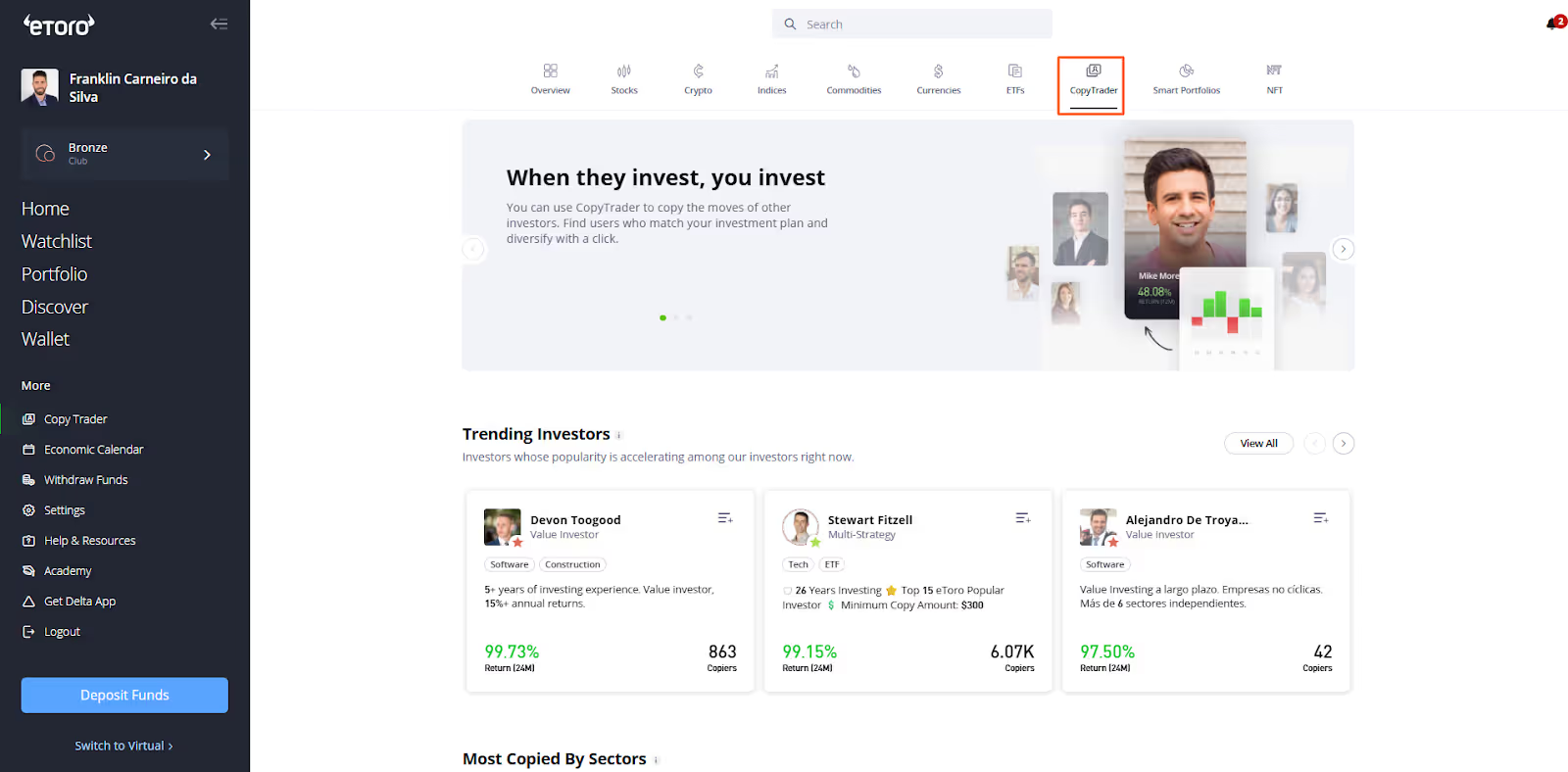

CopyTrader

eToro has built its reputation on innovation, offering unique tools that set it apart from traditional brokers. Among its most notable features is CopyTrader™, which lets you automatically replicate the trades of other eToro investors in real time. This allows even beginner investors to mirror the strategies of more experienced traders.

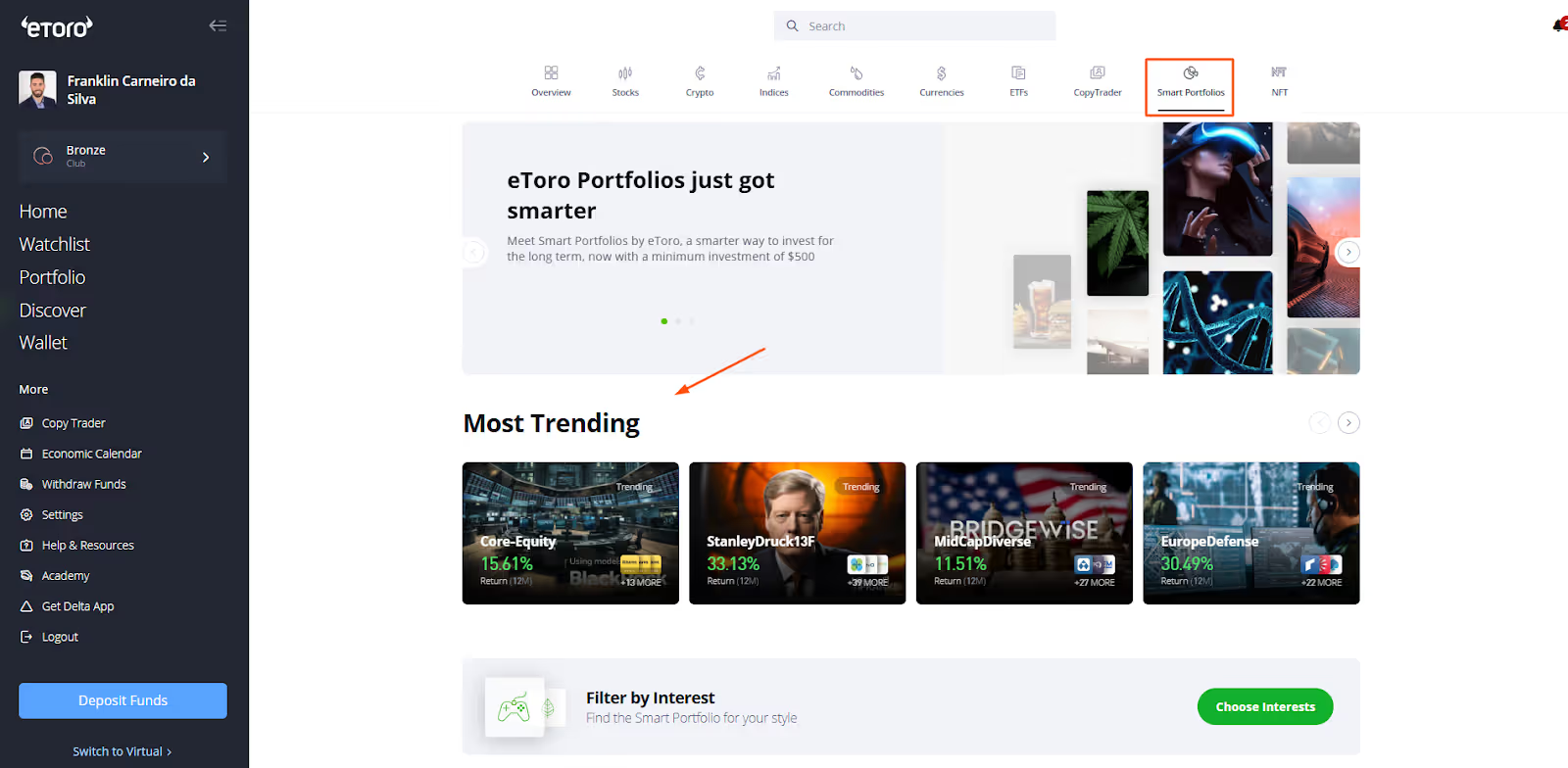

Smart Portfolios

Another standout feature is Smart Portfolios, a long-term, theme-based investment product. These portfolios group various assets based on a specific strategy or market sector, such as technology or renewable energy. They are professionally managed and monitored using machine learning to maintain alignment with the intended strategy.

In simple terms:

- CopyTrader™ lets you copy the trades of individual investors;

- Smart Portfolios provide access to a diversified portfolio of assets under a single investment, aligned with a broader market theme.

Here are a few examples of Smart Portfolios:

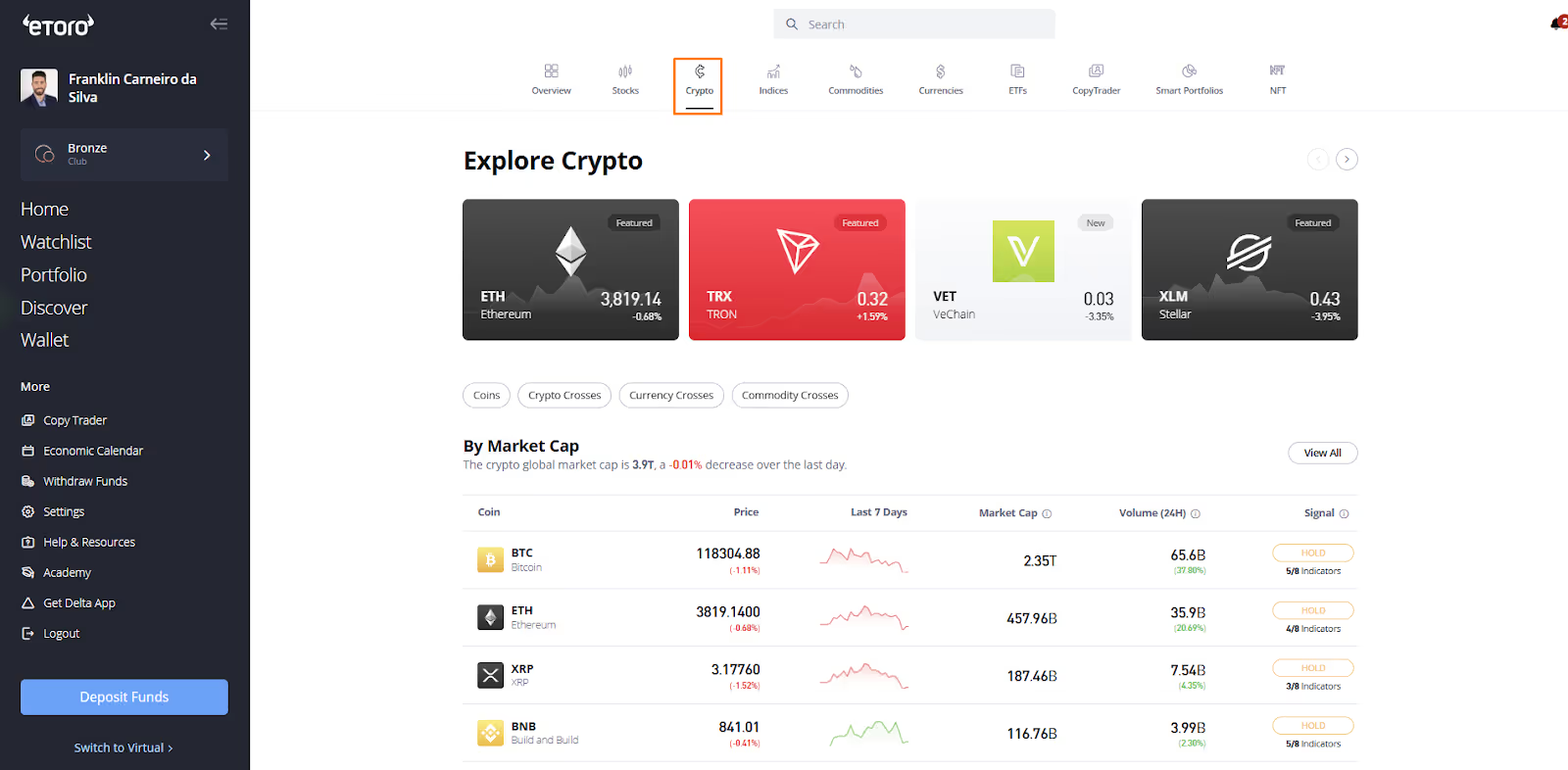

Cryptocurrencies

Besides, eToro allows you to invest in over +100 cryptocurrencies for a 1% spread regardless of the cryptocurrencies you are trading:

When investing in cryptocurrencies through eToro, you gain actual ownership of the underlying asset, similar to buying a real stock, as long as the following conditions are met:

- You are not using leverage (i.e., you’re not trading crypto via CFDs);

- You are not short-selling the cryptocurrency;

Educational resources

In addition to its trading features, eToro offers a wide range of educational resources to help investors improve their knowledge and skills. These include:

- eToro Academy – courses and tutorials for beginners and advanced traders;

- In-depth analysis – market insights and reports;

- News and Analysis – real-time updates on market trends;

- Digest & Invest – podcasts and research articles on relevant financial topics.

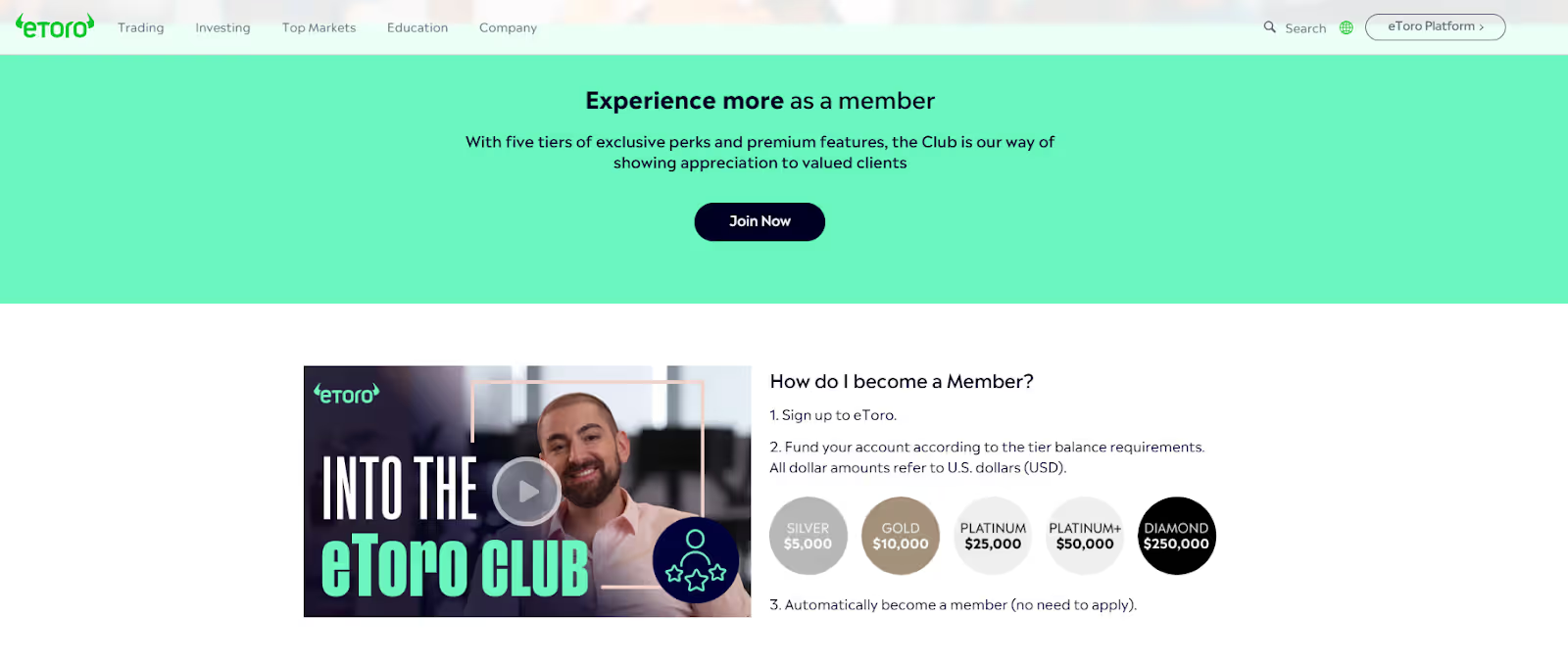

eToro Club

To reward active investors, eToro has created the eToro Club, a tiered membership program for users with higher account balances. Club members enjoy a range of exclusive benefits depending on their tier, such as:

- Lower fees and tighter spreads;

- Discounts on services;

- Complimentary subscriptions to premium tools;

- Invitations to VIP events and exclusive experiences.

Pros and cons

Pros

- Low stock trading fees, starting from $1 per trade on real stocks

- Free stock or crypto worth $50

- Access to UAE-listed shares via ADX and global markets on one platform

- Commission-free ETFs (note: other fees like spreads or conversion may apply)

- Social trading features like CopyTrader™ and Smart Portfolios

- Wide variety of financial products including global stocks, ETFs, crypto, forex, commodities, and indices

- Intuitive, user-friendly platform, ideal for beginners and intermediate investors

- Regulated by FSRA in the UAE, with strong compliance standards

- Local presence via eToro (ME) Limited in Abu Dhabi

Cons

- Withdrawal and inactivity fees apply even to UAE users

- Currency conversion fees can be costly for AED deposits (accounts are USD-denominated)

- No access to bonds, futures, or options

- Spreads and overnight fees may be higher than the industry average

eToro UAE bonus

A new user will earn $50 in stock or crypto by depositing at least $200.

Here’s how it works

- You need to sign up using our link (this is a must)

- After registration, choose your asset (Stock or crypto – it is up to you).

- Complete verification and deposit a minimum of $200

- Done! You got your first asset worth up to $50

Please note that the deposit amount must remain in your eToro account for at least 90 days to keep the $50. And only the first deposit to your eToro account shall count towards eligibility for the welcome bonus.

This video explains it clearly:

Trading platform

eToro offers both a web-based and mobile trading platform, and in this section, we’ll walk you through the web platform experience, which is accessible from any browser.

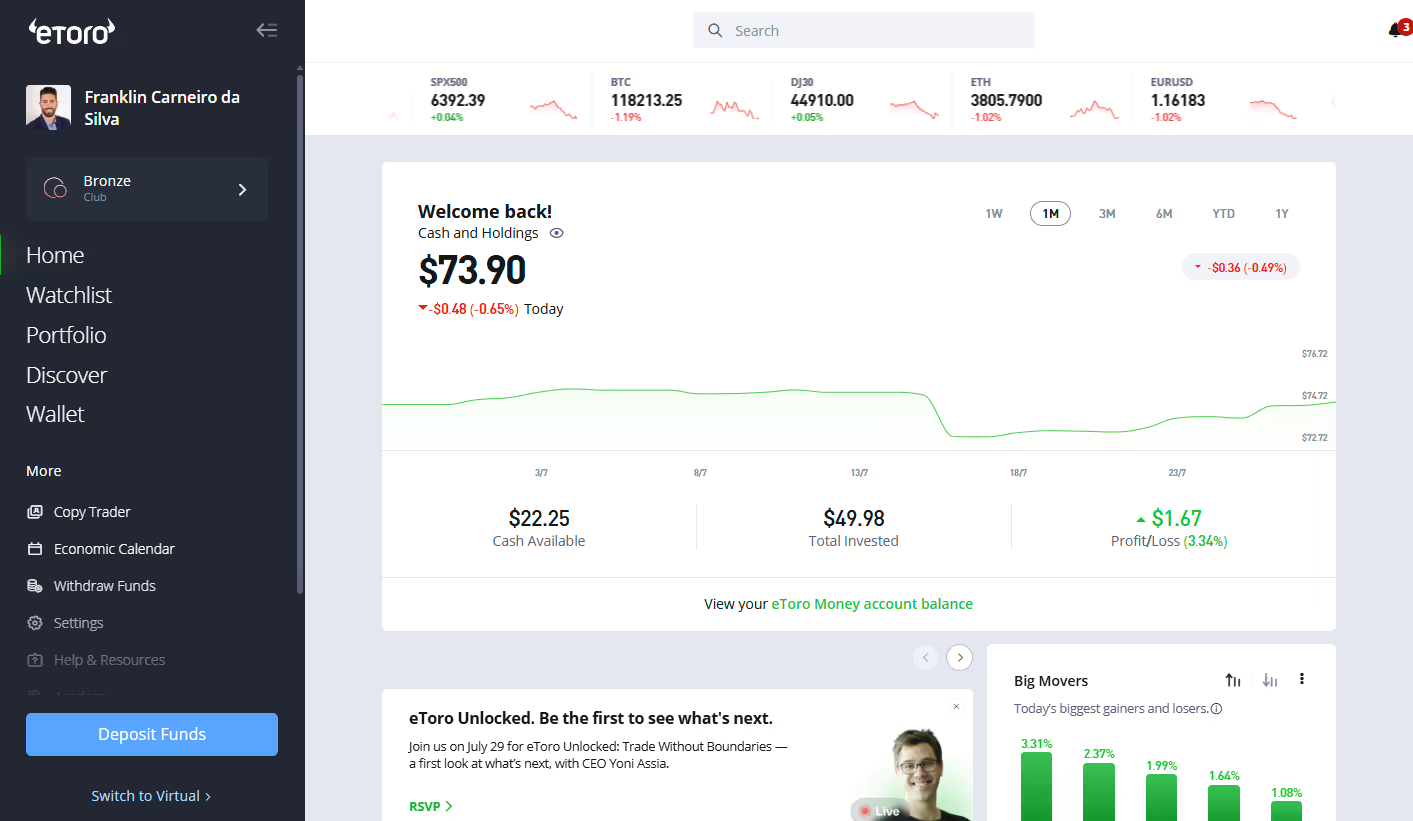

Platform overview

Once logged in, you’ll immediately see a search bar at the top where you can easily find any asset by name or ticker. You’ll have a clear view of your account overview, including total portfolio value, invested capital, and available cash. Just below it, there’s a dynamic “Big Movers” that highlights which assets are trending up or down:

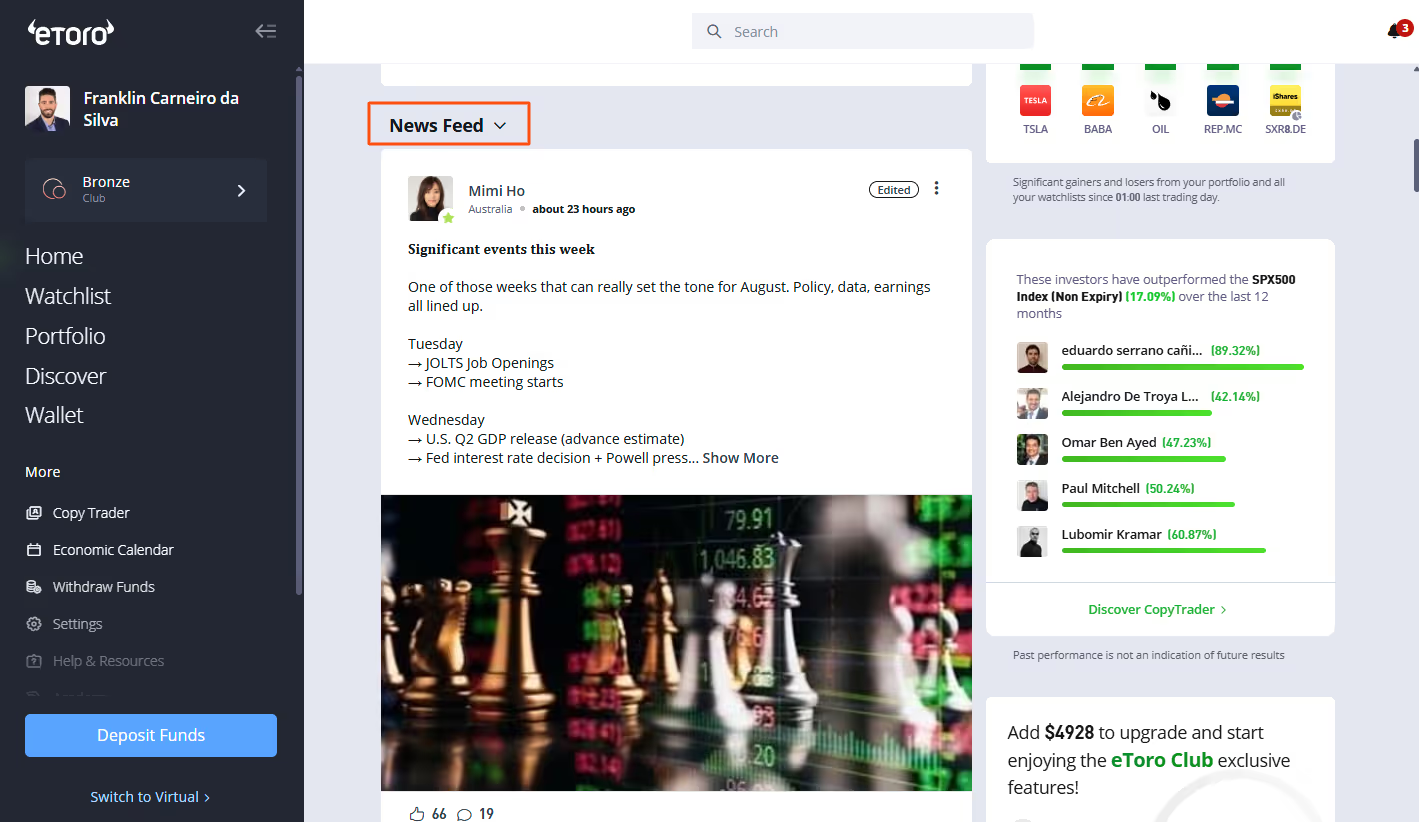

Social feed

Scrolling down the homepage reveals eToro’s news feed, which functions much like Facebook or Instagram. Here, users post market commentary, share their latest trades, and engage with the community. This feature supports eToro’s unique position as a social trading platform.

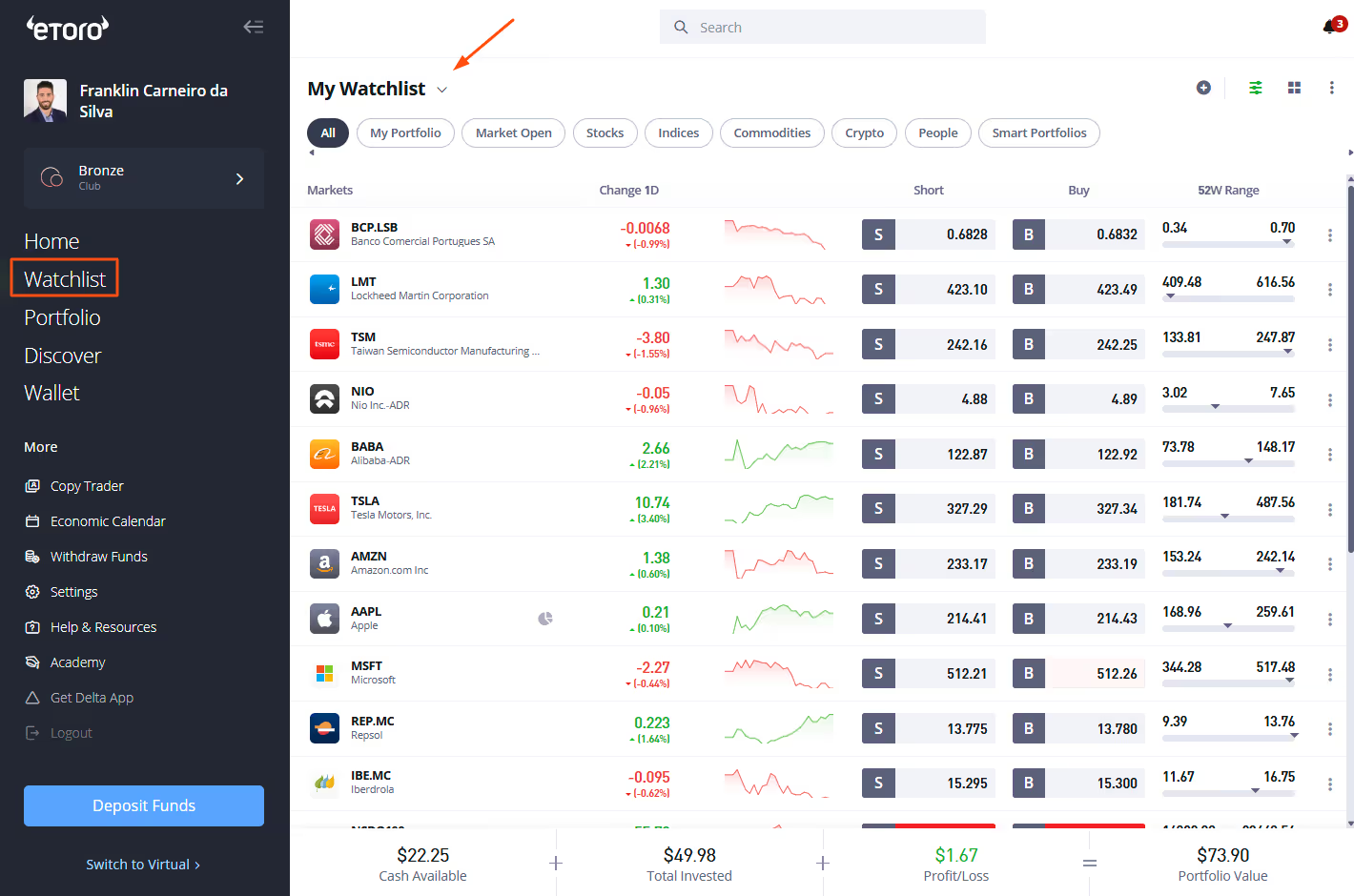

Watchlist

On the left-hand sidebar, you can access various tabs. One of the most useful is the Watchlist, where you can track assets you’re interested in or already own. It’s a simple way to monitor potential investments at a glance.

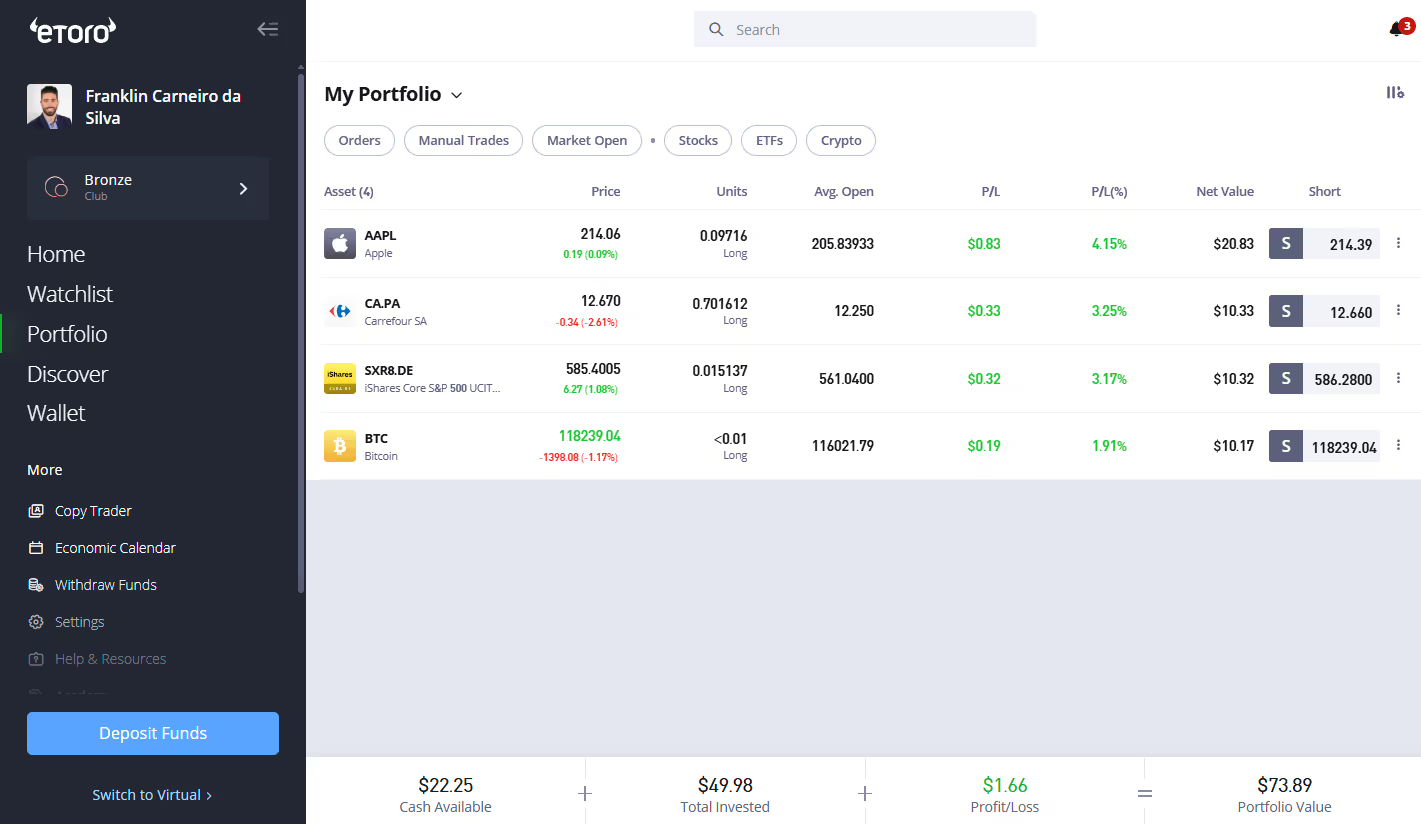

Portfolio view

The Portfolio tab provides a detailed breakdown of your holdings. You can see your current investments, along with profit/loss data in both absolute (USD) and percentage terms. The interface also separates your funds into “Cash Available”, “Total Invested” and “Profit/Loss”, making it easy to manage your finances.

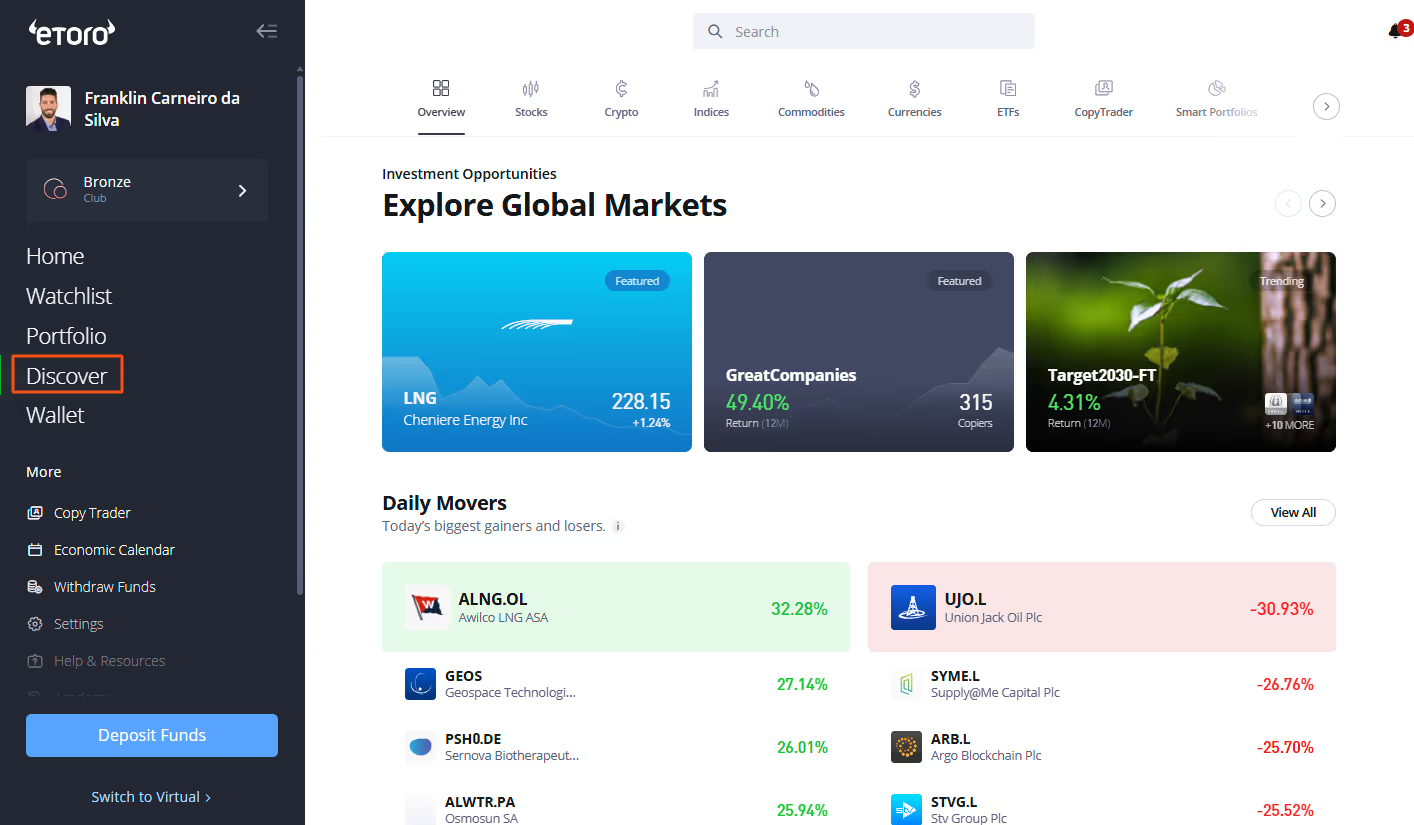

Discover tab

Under the Discover section, you’ll find a snapshot of what’s happening in the market. This includes:

- A list of available asset classes

- Investment Opportunities curated by eToro

- Daily Movers

- Trending Assets

This section is designed to help you explore and uncover new investing ideas.

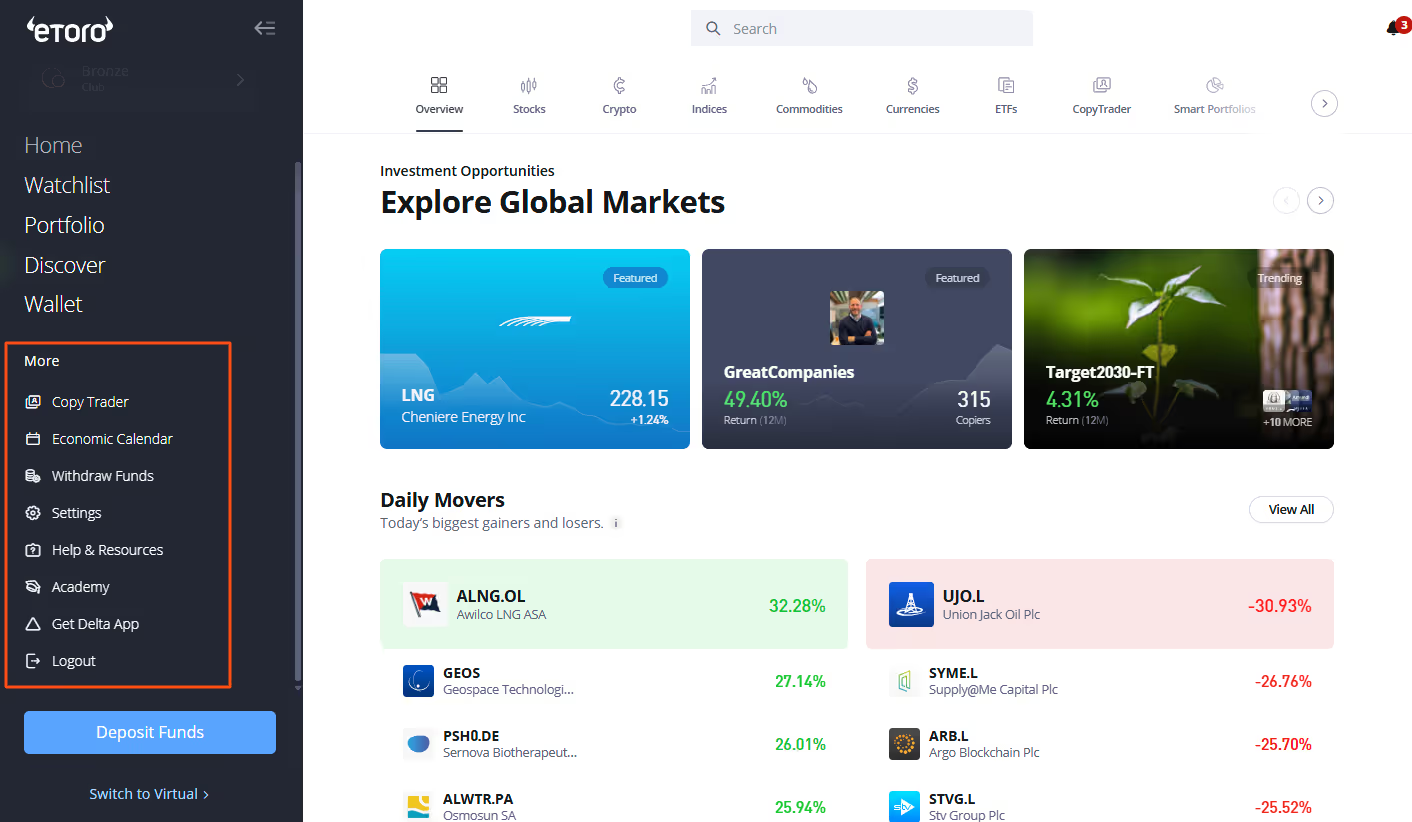

Other tools

On the left panel, you’ll also find quick links to:

- The economic calendar

- Options to deposit or withdraw funds

- Academy, accessible anytime

These tools make account management and market engagement smooth and intuitive.

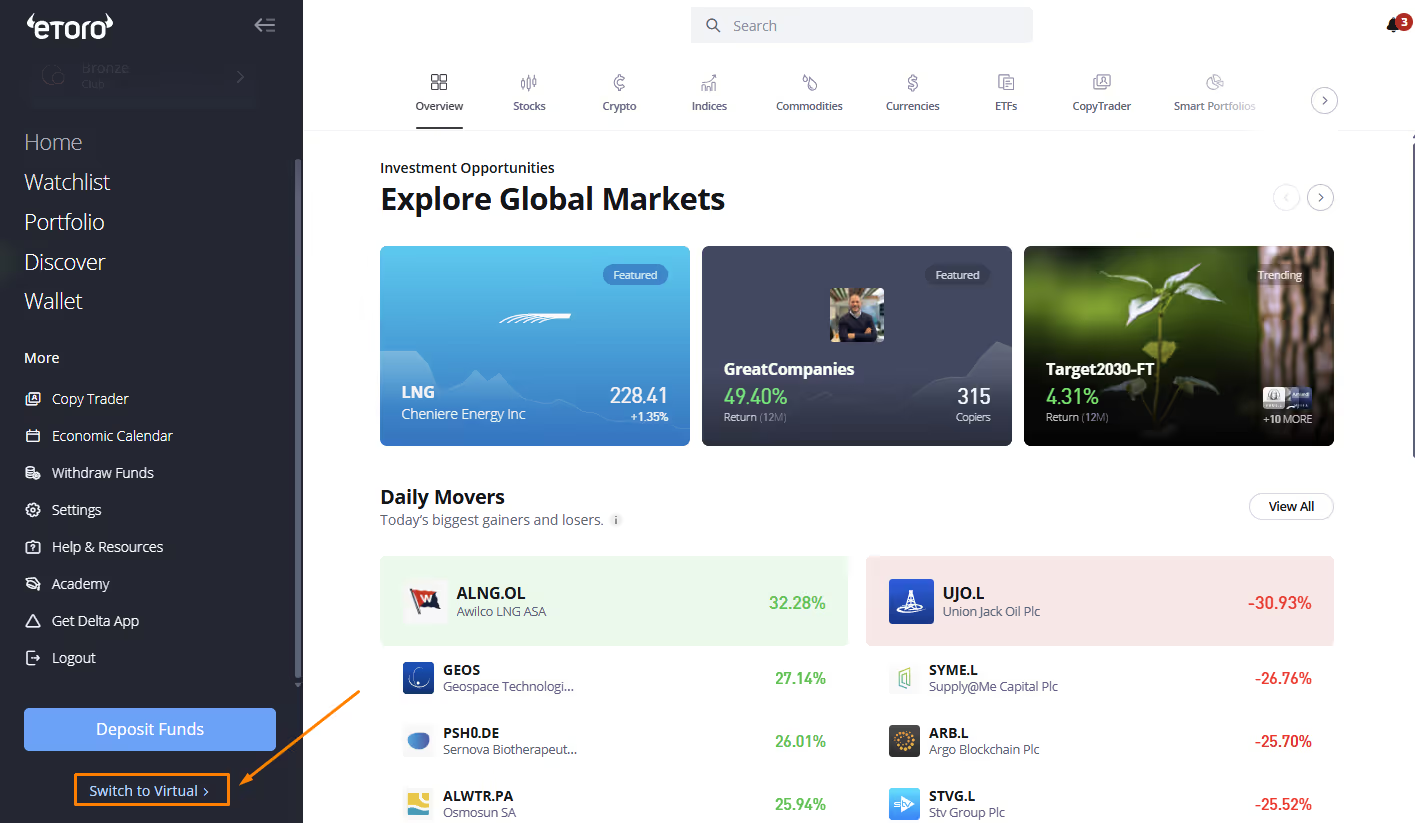

You can explore all of these features using a free demo account (Virtual Portfolio) with USD 100,000 in virtual funds, with no time limit on use, but selecting “Switch to virtual”:

Products & markets

You can invest in full shares or start with as little as $10, thanks to fractional investing.

International stocks, ETFs, crypto, CFDs

UAE clients can access a broad range of global markets, including equities, ETFs, cryptoassets, and derivatives/CFDs. They benefit from eToro’s full platform capabilities, which are available locally. ADGM approval covers securities, derivatives and cryptoassets trading.

Local UAE Markets (ADX, DFM)

In partnership with ADX (Abu Dhabi Securities Exchange), eToro has begun offering access to local UAE-listed securities via its UAE licence, expanding options for domestic market participation.

Stocks

eToro gives UAE users access to 3,000+ stocks from over 15 major global exchanges, including: NASDAQ, New York Stock Exchange (NYSE), London Stock Exchange, Frankfurt, and Amsterdam.

ETFs (Exchange-Traded Funds)

eToro offers both real ETFs and CFD-based ETFs to UAE investors through its locally regulated entity

You can invest in real ETFs, such as the iShares Core MSCI World UCITS (SWDA), which is EU-domiciled and directly held.

Additionally, popular U.S.-domiciled ETFs like SPY and VOO are also available for direct purchase, unlike in Europe, where such ETFs are restricted and only offered via CFDs due to PRIIPs regulation.

In the UAE, these restrictions do not apply, so investors may access these ETFs as real, underlying assets, provided the position is not leveraged or short.

Cryptocurrencies

UAE clients can trade 100+ cryptocurrencies, including well-known coins such as: Bitcoin (BTC), Ethereum (ETH), Dogecoin (DOGE), Ripple (XRP), Solana (SOL), and many others

Trades in supported coins can be unleveraged and held directly as assets (not CFDs), depending on your position type.

CFDs (and their leverage)

eToro offers a wide range of CFD products, allowing you to speculate on price movements without owning the asset. These include stocks, ETFs, forex, commodities, indices, and crypto.

Leverage options vary by asset class and are regulated by FSRA’s risk rules:

Alert: Leverage increases both potential profits and risks. UAE users should consider their risk tolerance carefully when using leveraged products.

Swap-free account

The eToro swap-free account is designed for traders who wish to avoid overnight interest charges (Riba) in line with Islamic finance principles. It allows clients to trade without incurring or earning interest on leveraged positions.

Key features

- No overnight interest: All trades on leveraged instruments (like CFDs) are exempt from overnight swap fees.

- Administrative fee instead of swaps: Instead of swaps, a fixed administrative fee will be charged following a set period of seven days.

- Same platform access: Swap‑Free account holders get full access to eToro’s trading platform and all its features.

- Wide range of instruments: Available for trading CFDs on stocks, indices, commodities, and more.

Note: You must first open a standard eToro account and then request an upgrade to a Swap‑Free account. Also, this account is not officially "Sharia-certified," but it is structured to avoid interest. Swap-free conditions apply only to specific instruments.

Fees

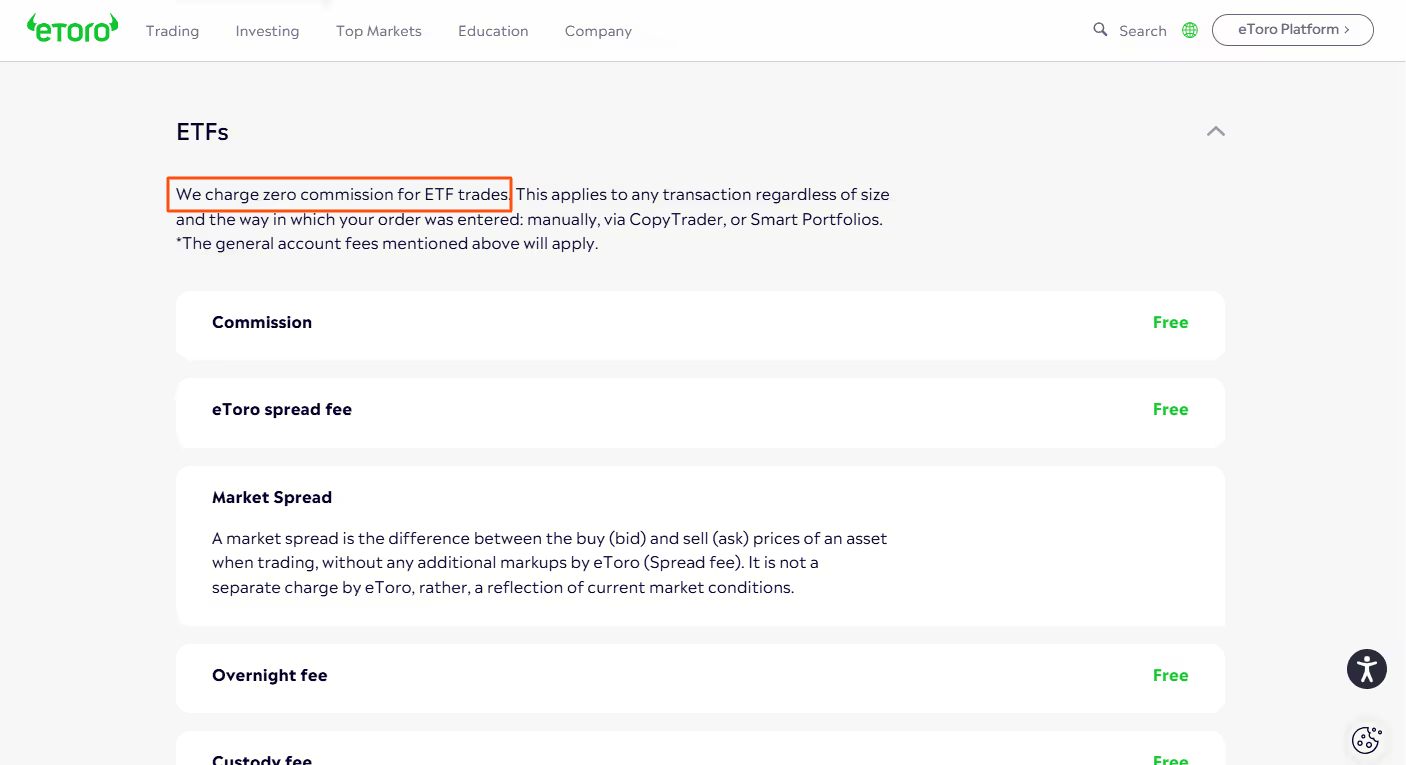

eToro offers a transparent fee structure for UAE clients. While ETF trading is commission-free, there are other costs to consider, such as fees on stocks, spreads, overnight fees, withdrawal charges, and currency conversion fees.

Trading fees overview

Stock and ETF Trading

For UAE clients, eToro offers zero-commission trading on ETFs, provided you’re placing a non-leveraged, long position:

Note that commission-free ETF trading only applies to real assets. Leveraged or short positions are treated as CFDs, which do include fees such as spreads and overnight charges.

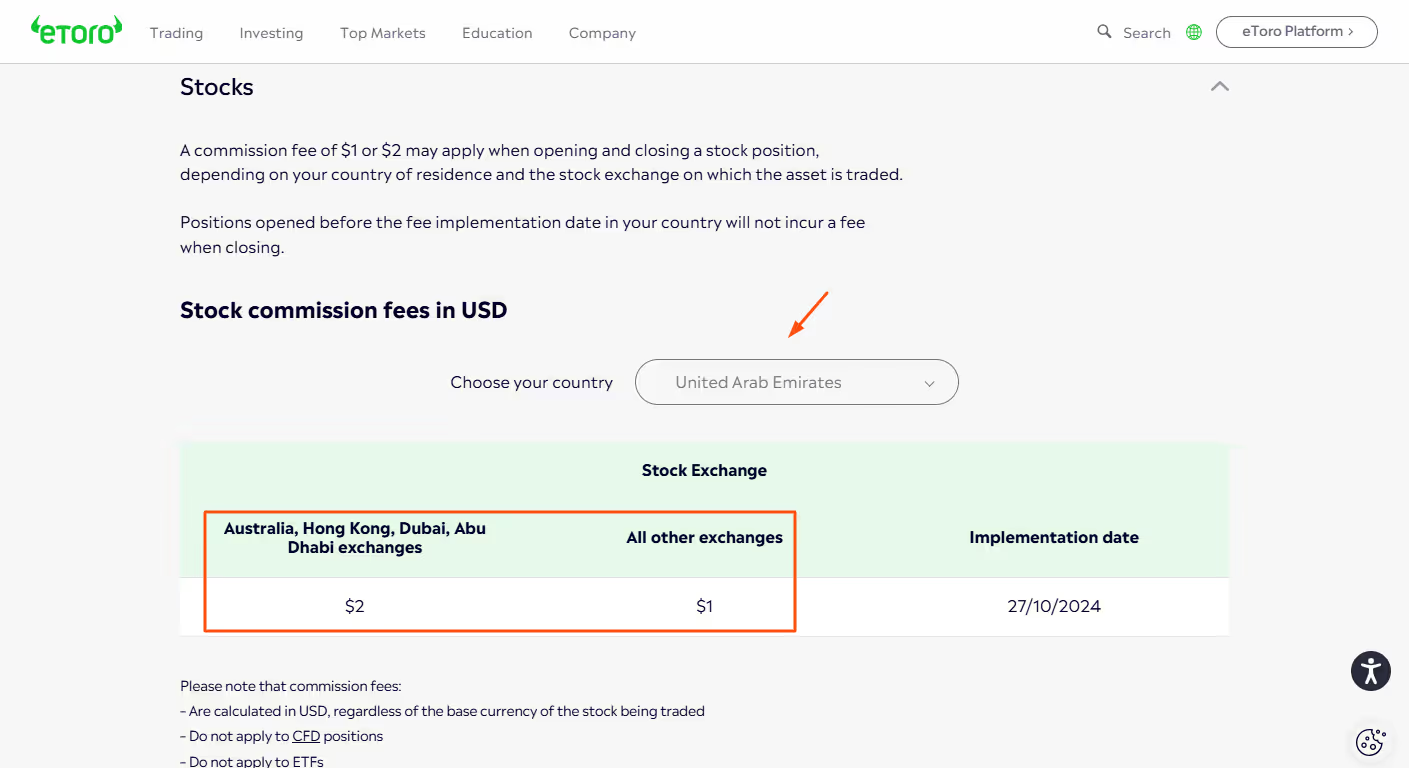

However, you pay a fee of up to $2 per trade in stocks, depending on the exchanges:

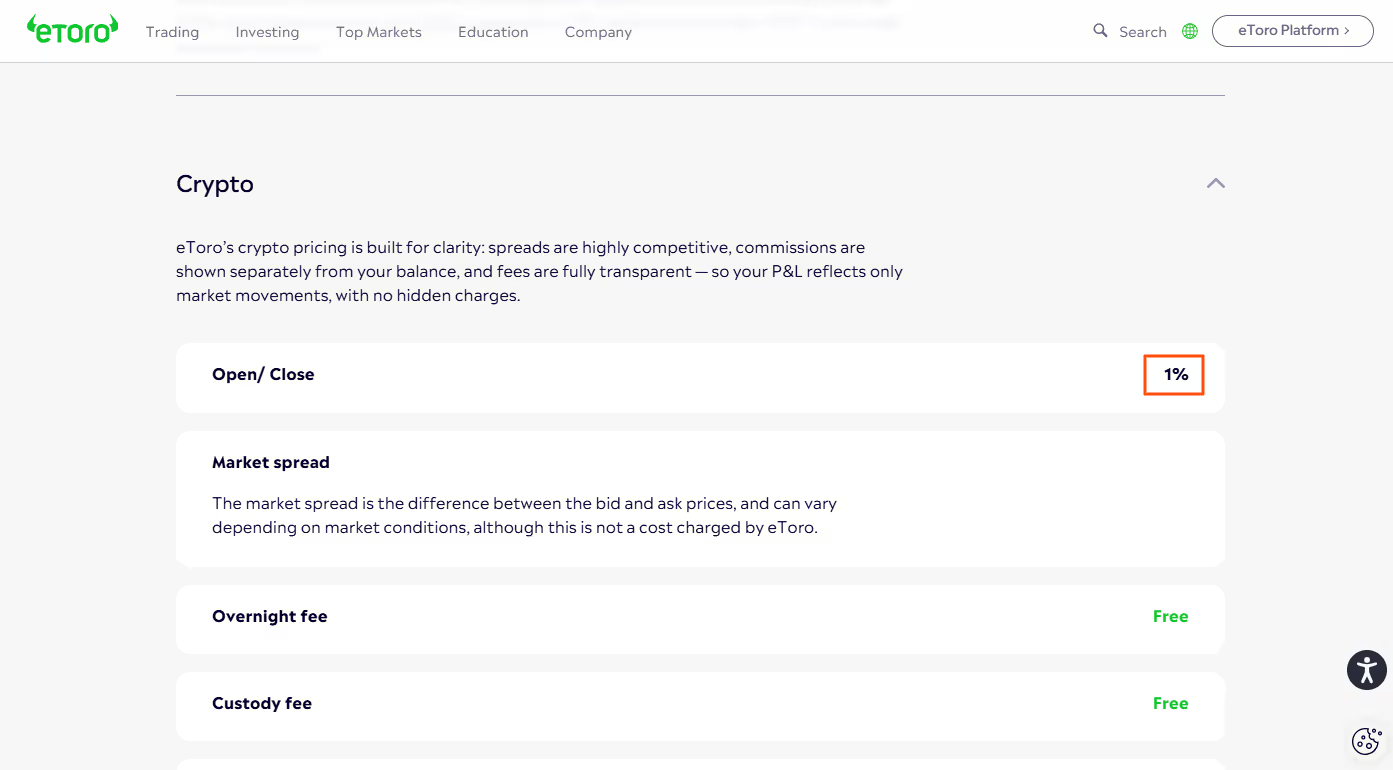

Crypto trading fees

eToro charges a flat 1% fee on all cryptocurrency trades, both buying and selling:

No leverage is allowed on crypto trades in the UAE, so all positions are taken as real assets with no overnight fees.

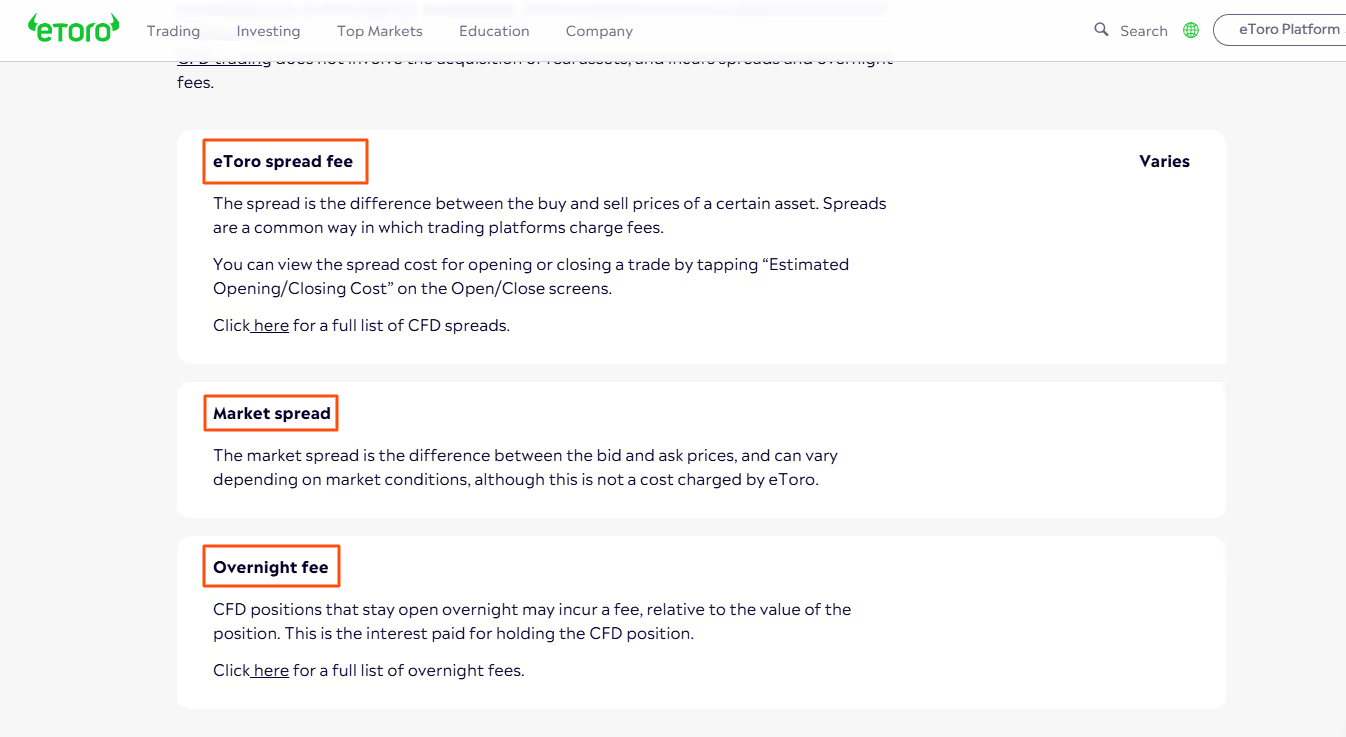

CFD fees

If you trade using CFDs (Contract for Difference), you may incur the following charges:

- Spreads – typically higher on less liquid assets

- Overnight Fees – applied daily on leveraged positions, based on the Libor + eToro markup

These costs vary depending on the asset class, volatility, and your position size.

Non-trading fees

Here’s a summary of non-trading costs relevant to UAE users:

- Deposit Fees: None

- Currency Conversion Fee: Applies when depositing in AED

- Withdrawal Fee: $5 per withdrawal (min. withdrawal amount: $30)

- Waived for Platinum, Platinum+ and Diamond Club members

- Inactivity Fee: $10/month after 12 months of no log-in activity

- CopyTrader™ and Smart Portfolios: Free to use

💡 Tip: Always deposit in USD if possible to avoid currency conversion charges.

Regulation and licensing in the UAE

For residents of the United Arab Emirates, eToro operates under the fully regulated entity eToro (ME) Limited, which is licensed by the Abu Dhabi Global Market (ADGM) and supervised by its independent regulator, the Financial Services Regulatory Authority (FSRA).

eToro (ME) Limited was granted its Financial Services Permission (FSP No. 220073) on 16 October 2023. This licence enables eToro to offer its full investment services legally and safely to UAE-based clients.

UAE clients are not covered by a UK/EU investor-compensation scheme.

What activities is eToro licensed to perform?

Under its FSRA licence, eToro is authorised to conduct a wide range of investment-related activities, including:

- Dealing in investments as principal (matched) – i.e., executing trades on behalf of clients;

- Arranging investment deals – facilitating the buying/selling of securities and financial instruments;

- Managing assets – allowing for portfolio management, including Smart Portfolios;

- Providing and arranging custody, including the safekeeping of assets such as stocks and cryptoassets.

This means eToro (ME) Limited is fully authorised to offer both traditional securities and digital assets (like Bitcoin and Ethereum), a significant advantage in a region where many platforms still do not offer regulated access to crypto.

What does the FSRA regulation mean for you?

Being regulated under the FSRA offers UAE investors a high standard of financial protection, equivalent to other globally respected regulatory bodies like the UK’s FCA or Australia’s ASIC. Key benefits include:

- Segregation of client funds from the broker’s own funds;

- Strict capital adequacy requirements and financial audits;

- Market conduct rules that promote transparency and fair dealing;

- Legal framework for handling complaints and disputes via FSRA’s regulatory channels.

eToro’s licensing in the UAE represents a strong signal of trust and compliance with international best practices, particularly important for investors concerned about platform legitimacy and legal recourse.

Still, UAE investors are not covered under any investor compensation scheme, as is the case with the EU or UK investor compensation schemes (e.g., €20,000 under CySEC or £85,000 under FCA).

Finally, eToro is a publicly listed company, trading on the NASDAQ under the ticker symbol ETOR, following a successful Initial Public Offering (IPO) in May 2025, which means they are required to publish their financial statements (additional level of transparency):

How to fund your eToro account in AED (Step-by-Step)

Funding your eToro account from the UAE can be done in several ways, but not all options have the exact cost or speed. Below is a practical breakdown:

Local bank wire (Mashreq Neo & ADCB)

- Transfer AED directly to eToro via supported banks like Mashreq Neo or ADCB.

- Processing time: 1–3 business days.

- Usually lower fees compared to card payments.

Debit/Credit card (Instant)

- Fund instantly using your credit or debit card.

- FX conversion fee applies because eToro accounts are in USD.

- Fast but more expensive for larger amounts.

Wise (USD workaround)

- Use Wise to convert AED to USD at interbank rates.

- Send the USD to eToro to avoid the FX mark‑up charged by eToro.

- Best option for cost efficiency is if you can handle the extra transfer step.

Who is eToro best suited for?

eToro is a flexible and user-friendly platform that caters to a wide range of investor profiles, but it especially stands out for certain types of users in the United Arab Emirates. Here's who is likely to benefit the most from using eToro (ME) Limited:

Beginner and intermediate UAE investors

eToro’s intuitive interface, low-cost structure, and access to both local and global markets make it an excellent choice for first-time investors or those with some market experience. Features such as virtual trading accounts (demo mode) and educational content via the eToro Academy help beginners become comfortable before committing real capital.

Investors seeking global + regional market access

Through its UAE entity regulated by ADGM’s FSRA, eToro offers exposure to over 3,000 global stocks, UAE-listed companies via ADX, ETFs, cryptocurrencies, and a wide range of CFDs on indices, commodities, and forex. This makes it ideal for investors who want to manage an international portfolio alongside local opportunities from one platform.

Fans of social trading and CopyTrader™

If you're interested in following or copying other traders, eToro is one of the few platforms in the UAE offering real-time social trading. You can view the performance and strategies of other users and automatically replicate their trades through CopyTrader™, a standout feature for passive or time-constrained investors.

Investors with modest starting capital

With fractional shares, a minimum deposit of $100 and a minimum trade size of just $10, eToro lowers the barrier to entry for UAE residents who want to build a diversified portfolio without needing a large upfront investment. This makes it suitable for university students, young professionals, or anyone looking to test the waters.

Final verdict

eToro, via its ADGM‑regulated entity, is a credible, accessible, and user‑friendly investing platform for UAE residents. With local licensing, combined global and local market access, and innovative social trading features, it is particularly appealing for retail investors, new to investing or looking to diversify.

However, occasional users should be aware of inactivity and conversion fees, and more active traders should note possible latency and limited advanced order types.

For UAE retail investors seeking a regulated, low-entry, socially focused multi-asset platform, including local ADX access, eToro (ME) Limited scores highly. Be mindful of potential non-trading charges and CFD risk profiles.

Frequently Asked Questions (FAQs)

1. Is eToro halal?

eToro isn't officially Sharia-certified, but it offers a swap-free (Islamic-style) account that eliminates interest charges on leveraged positions. Many Muslim traders consider this arrangement compliant in principle, provided they avoid prohibited assets and only use permissible instruments.

2. Is eToro allowed in the UAE?

Yes, eToro is regulated by the ADGM FSRA to offer financial services in the UAE. Plus, they support UAE-based accounts with services including Swap‑Free account upgrades.

3. How long do AED withdrawals take?

Withdrawals in AED are processed in USD and are typically converted before reaching your bank. They often take 1–3 business days via bank transfer, depending on the method used, though eToro charges a flat $5 withdrawal fee.

4. If I want a swap‑free account, do I need to activate it?

To activate the Swap‑Free (Islamic-style) account, you must first open a standard account and then deposit a minimum of USD 1,000. The Swap-Free status must be requested subsequently via support.

5. Are administrative fees charged on Swap‑Free accounts?

Yes, after the seven-day grace period, daily administrative fees are applied to CFD positions held overnight (excluding crypto CFDs). These fees vary by asset class but are not linked to interest. Real stocks, ETFs, and cryptocurrencies are not subject to such fees.

6. Can I trade any instrument with a Swap‑Free account?

Yes. The Swap-Free account grants access to all instruments available on eToro, including CFDs, real stocks, ETFs, indices, commodities, and cryptocurrencies. However, please note that leverage-based products may still incur fees beyond the grace period.

7. What is the difference between Swap‑Free and Sharia compliance?

While Swap‑Free accounts remove overnight interest (Riba), they do not guarantee Sharia compliance. Some Islamic scholars argue leveraged CFDs may still be impermissible. Users must ensure that the actual assets traded (e.g., non-leveraged shares) align with Sharia principles.

8. Are my real shares held in custody? Do I own them directly?

When buying non-leveraged stocks or ETFs, eToro acquires the underlying asset on your behalf and holds it in custody in a pooled "omnibus" account. You benefit from ownership exposure but do not receive direct registration in your name.